Effective Friday 28 April 2023, Resi Select is changing fixed interest rates for fixed rate home loans across all terms for Owner Occupiers and Investors.

A full set of rates are available here

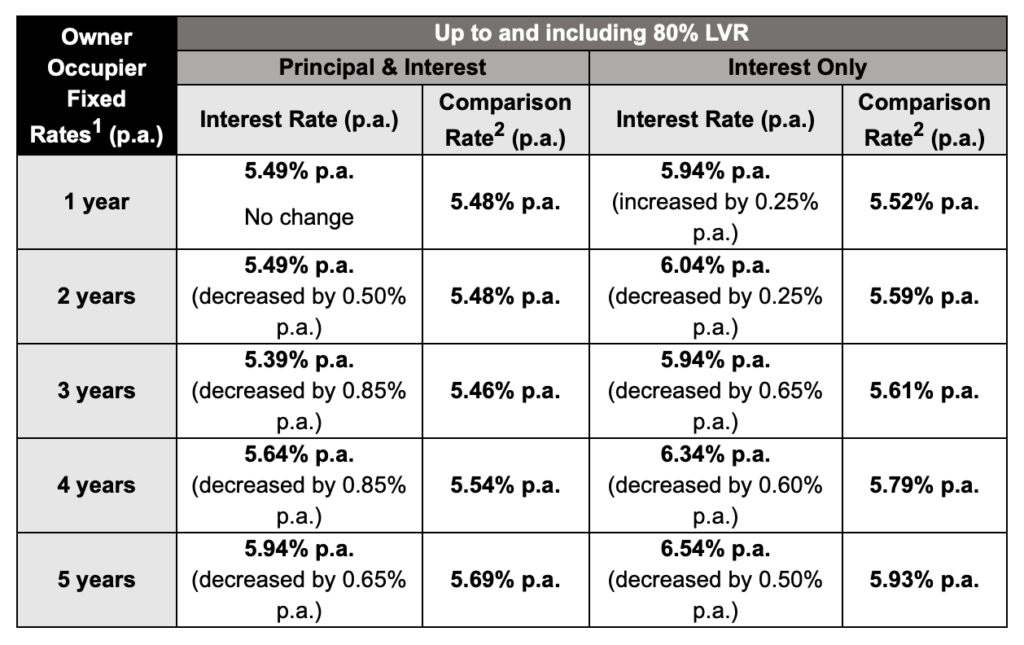

Fixed rates for ≤80% LVR new lending effective Friday 28 April 2023.

Key rates below. A full set of rates are available on the rate cards and our systems.

Note: 80.01-90% LVR fixed rates (where applicable) will be set 10bps above new ≤80% LVR fixed rates, and >90% LVR fixed rates (where applicable) will be set 20bps above the new 80.01-90% LVR fixed rates.

For more important information on comparison rates, please refer to ‘Important Information’ section below.

Eligibility applies to:

- New fixed rate home loans on or from Friday 28 April 2023.

- Existing customers who apply to fix all or a portion of their existing variable rate loan, will also be able to access the new rate on or from Friday 28 April 2023.

- The above fixed rate changes do not impact existing fixed rate loans.

Lock Rate

The actual fixed rate that will apply will be the effective fixed rate as at the time of settlement, unless the customer takes out Lock Rate. Lock Rate can give your customers fixed-rate certainty for 90 days from the date the lock rate application is submitted. A Lock Rate fee of $395 applies where the Lock Rate option is requested. For more details, please refer to the Lock Rate Authority Form.

Pipeline applications for new fixed interest rate home loans

- The fixed interest rate that will apply to pipeline applications will be the applicable fixed rate at the time of settlement, except where Lock Rate applies.

- If Lock Rate applies, the fixed interest rate that will apply is the fixed rate as at the date the Lock Rate Authority Form was lodged.

Existing customers & changes to home loans

- Customers who make a request to switch from a variable to a fixed rate, or to re-fix1 their rate before Friday 28 April 2023 will receive the rate that applied at the time we receive the Fixed Rate Authority form. Existing fixed rate loan customers should consider the remaining term and any economic cost that may apply, if they decide to re-fix 1, before expiry of their current fixed rate term.

- For clarity, any requests switching from a variable to a fixed rate or re-fix1 a rate on or after Friday 28 April 2023 will receive the new fixed rates.

Don’t forget the benefits of choosing Resi Select

- A digital end-to-end service experience to support you with efficient lodgement and processing of your applications.

- Direct access to credit managers, with optimal turnaround times for quality applications.

- A simpler product offering.

- Customer Net Promoter Score (NPS) +26 and Broker NPS +64 in Advantedge Broker and Customer Satisfaction Surveys July 2022*.