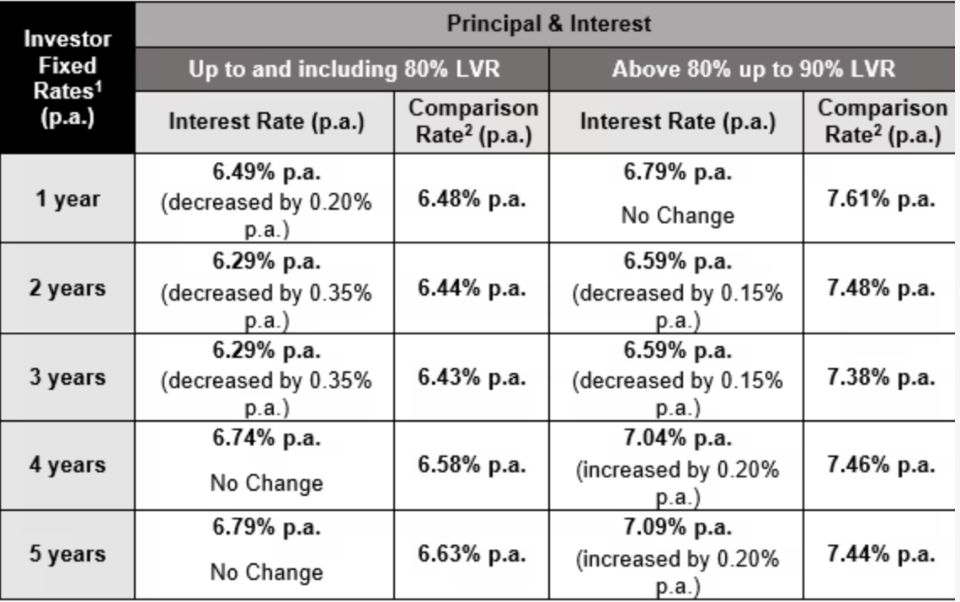

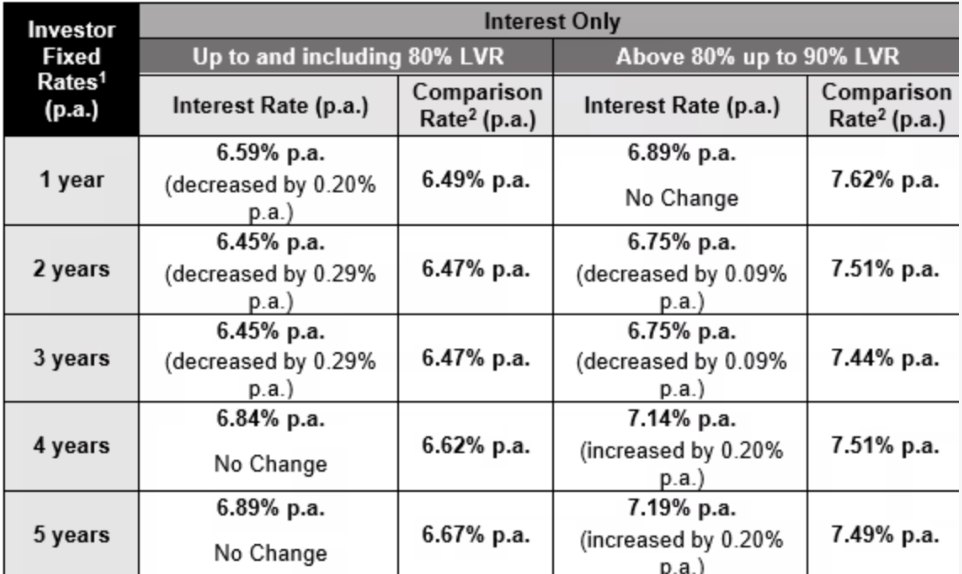

Effective Wednesday 1 May 2024, Resi Select is changing interest rates for fixed rate home loans for Owner Occupiers making Principal and Interest repayment and Residential Investors.

A full set of rates (including interest only fixed rates) are available here and on our systems from Wednesday 1 May 2024.

Fixed rates for new lending effective Wednesday 1 May 2024. Key rates below. A full set of rates are available on the rate cards and our systems.

Note: 80.01-90% LVR fixed rates (where applicable) will be set 30bps above new ≤80% LVR fixed rates, and >90% LVR fixed rates (where applicable) will be set 20bps above the new 80.01-90% LVR fixed rates.

For more important information on comparison rates, please refer to ‘Important Information’ section below.

Eligibility applies to:

- New fixed rate home loans on or from Wednesday 1 May 2024.

- Existing customers who apply to fix all or a portion of their existing variable rate loan, will also be able to access the new rate on or from Wednesday 1 May 2024.

- The above fixed rate changes do not impact existing fixed rate loans.

Lock Rate

The actual fixed rate that will apply will be the effective fixed rate as at the time of settlement, unless the customer takes out Lock Rate. Lock Rate can give your customers fixed-rate certainty for 90 days from the date the lock rate application is submitted. A Lock Rate fee of $395 applies where the Lock Rate option is requested. For more details, please refer to the Lock Rate Authority Form.

Pipeline applications for new fixed interest rate home loans

- The fixed interest rate that will apply to pipeline applications will be the applicable fixed rate at the time of settlement, except where Lock Rate applies.

- If Lock Rate applies, the fixed interest rate that will apply is the fixed rate as at the date the Lock Rate Authority Form was lodged.

Existing customers & changes to home loans

- Customers who make a request to switch from a variable to a fixed rate, or to re-fix1their rate before Wednesday 1 May 2024 will receive the rate that applied at the time we receive the Fixed Rate Authority form. Existing fixed rate loan customers should consider the remaining term and any economic cost that may apply, if they decide to re-fix1, before expiry of their current fixed rate term.

- For clarity, any requests switching from a variable to a fixed rate or re-fix1 a rate on or after Wednesday 1 May 2024 will receive the new fixed rates.

For more important information on comparison rates, please refer to ‘Important Information’ section below.

Don’t forget the benefits of choosing Resi Select

- A digital end-to-end service experience to support you with efficient lodgement and processing of your applications.

- Direct access to credit managers, with optimal turnaround times for quality applications.

- A 24-hour turnaround (SLAs).

- Customer Net Promoter Score (NPS) +6 and Broker NPS +38 in Advantedge Broker and Customer Satisfaction Surveys July 20233

If you have any questions, please contact your Resi Business Development Manager.