In line with the November RBA announcement, effective today Monday 28 November 2022, Resi Select is increasing variable interest rates for both new and existing variable rate home loans.

Effective today Monday 28 November 2022, variable rates are increasing for new and existing lending by 0.25% p.a.

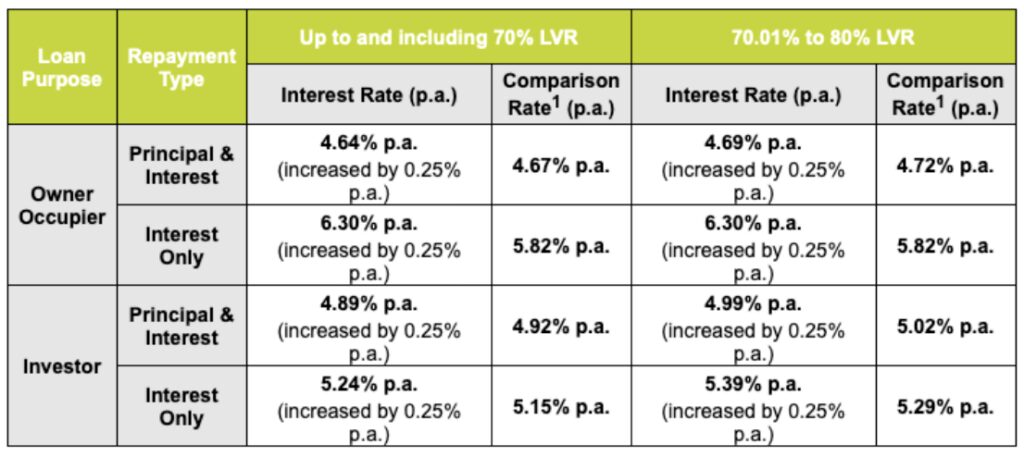

For example, interest rates for new lending with ≤80% LVR will be as follows:

Comparison rate disclaimer:

The comparison rate is based on a loan for $150,000 and a term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Information and interest rates are current and are subject to change. Terms, conditions, fees, charges and credit criteria apply.

How we’re telling your customers

Customers with an existing variable rate home loan will receive a letter advising them of changes to their interest rate and repayments.

Pipeline applications – timing

- The effective date of this change will be no earlier than this Monday 28 November 2022 for in-flight applications, but will vary depending on the loan settlement date as follows:

- Loans settled before 5pm Monday 7 November 2022 will have variable rates increased by 0.25% p.a. on Monday 28 November 2022.

- Loans settled after 5pm Monday 7 November 2022 will retain their current contracted variable rates until the month following settlement, when they will be increased by 0.25% p.a. The adjustment will not be retrospective.

- All variable rate loans formally approved and instructed on or after Monday 28 November 2022 will receive the rates on the updated rate card.

Pipeline applications – reassessment

- AIP – to purchase a property. This can be in place for 90 days providing there is no credit critical change. The LVR & loan amount at the time of approval cannot increase if pipeline treatment rules are to be applied.

- Conditional Approval to refinance / cash out / consolidation etc. These loan applications must service at the rate of the date of the final loan assessment.

A full set of rates will be made available on our systems from Monday 28 November 2022.

For more important information on comparison rates, please refer to the ‘Important Information section below.

Don’t forget the benefits of choosing Resi Select

- A digital end-to-end service experience to support you with efficient lodgement and processing of your applications.

- Direct access to credit managers, with optimal turnaround times for quality applications.

- A simpler product offering.

- Customer Net Promoter Score (NPS) +26 and Broker NPS +64 in Advantedge Broker and Customer Satisfaction Surveys July 2022*.

If you have any questions, please contact your Resi Select Business Development Manager.

Arthur Karvelas

Head of Resi Distribution