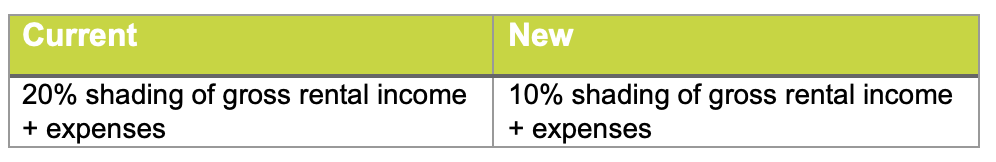

Effective Saturday 12 November 2022, the shading applied to rental income will reduce from 20% to 10% for new and existing rental properties.

Expenses related to rental properties must continue to be captured as part of the living expenses conversation.

As a result of this change, the average borrowing power is estimated to increase by 8% for customers who have rental income and there will be less applications requiring manual credit assessment.

Why we’re making this change

Rental income is a key contributor to total income in Advantedge home loan applications. We want to ensure our credit approach is in line with market conditions while continuing to lend responsibly.

The Australian rental market has seen substantial income growth and change in the last 12 months, with high demand and record-low vacancy rates driving up rents. In response to this, we are reducing the amount we shade rental income in home loan applications.

This change will support customers looking to refinance to get a better interest rate, improve their cashflow by reducing payments or increase their lending to achieve their goals.

What you need to do

You don’t need to do anything differently. All systems and tools, including Advantedge serviceability calculators, will be updated on 12 November 2022.

Please keep this updated policy front of mind when having discussions with your customers about how Advantedge may be a great option to suit their needs.

Pipeline Applications

- All applications assessed or reassessed after 12 November 2022 will have the lower rental shading applied.

- Any applications which previously did not service can be reassessed under the new shading rules.

If you have any questions in the meantime, please contact your Resi Select BDM or email [email protected]