Resi Select – Variable Interest Rate Update

In line with the June 2023 RBA announcement, effective Tuesday 4 July 2023, Resi Select is increasing variable interest rates for both new and existing variable rate home loans.

Effective Tuesday 4 July 2023, variable rates are increasing for new and existing lending by 0.25% p.a.

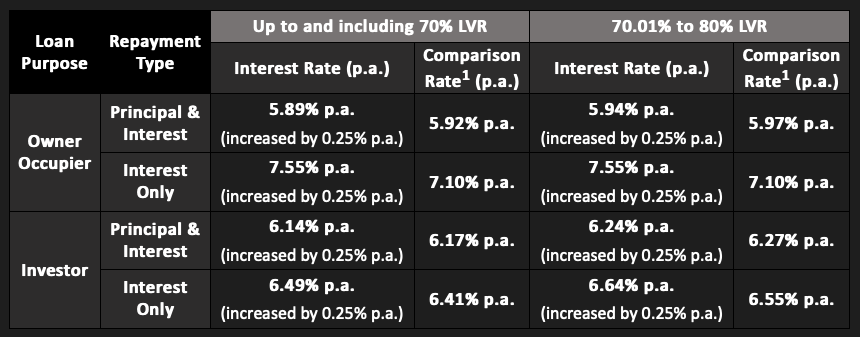

For example, interest rates for new lending with ≤80% LVR will be as follows:

How we’re telling your customer…

Customers with an existing variable rate home loan will receive a letter advising them of changes to their interest rate and repayments.

Pipeline applications – Timing

The effective date of this change will be no earlier than Tuesday 4 July 2023 for in-flight applications, but will vary depending on the loan settlement date as follows:

- Loans settled before 5pm Tuesday 13 June 2023 will have variable rates increased by 0.25% p.a. on Tuesday 4 July 2023

- Loans settled after 5pm Tuesday 13 June 2023 will retain their current contracted variable rates until the month following settlement, when they will be increased by 0.25% p.a. The adjustment will not be retrospective.

All variable rate loans formally approved and instructed on or after Tuesday 4 July 2023 will receive the rates on the updated rate card.

Pipeline applications – reassessment

- AIP – to purchase a property

This can be in place for 90 days providing there is no credit critical change.

The LVR & Loan amount at time of approval cannot increase if pipeline treatment rules are to be applied.

- Conditional Approval to refinance / cash out / consolidation etc

These loan applications must service at the rate of the date of the final loan assessment.

A full set of rates will be made available on our systems from Tuesday 4 July 2023.

If you have any questions, please contact your Resi Select Business Development Manager.

ZipID no longer available from 15 June

From today, Thursday 15 June, ZipID will be removed from market and therefore will no longer be available for you to verify your customer’s identity when applying for a Resi Select home loan.

To accommodate this change, the ZipID function will be removed from ApplyOnline from next month.

In progress ZipID reports

Reports generated via ZipID prior to 15 June will continue to be accepted for up to 90 days.

If you need to submit a ZipID report after the functionality is removed from ApplyOnline, please submit the ZipID report using the IDYou condition card.

IDYou is still available

You can continue to use IDYou as a non-face-to-face method of verifying you customer’s identity.

For support, please take a look at the digital verification of ID page on the Advantedge website, which includes:

- Access to these IDYou user guides

- A video demo on how to complete the IDYou process when dealing with customers remotely and in person.

If you have any questions, please speak to your Resi Select Business Development Manager.

Scheduled System Maintainence

There will be a scheduled system outage on Sunday 18 June from 12:00am – 1:00pm.

What this means for you

During the outage you’ll still be able to submit applications via ApplyOnline, however you won’t receive a credit decision or reference number until systems are restored. You can continue using LoanApp during this time to capture data but will be unable to submit loan applications until systems are restored.

What this means for your customers

During the outage period customers will be unable to access StarNet to check their account information or transfer funds.

There will be a banner on StarNet notifying customers of the outage.

StarNet and Preferred Lender outage

StarNet and Preferred Lender will be unavailable on Saturday 24 June from 12:00 to 4:00am.