Resi has made some exciting Essential Options product enhancements, if you havent heard about them, please check out the following:

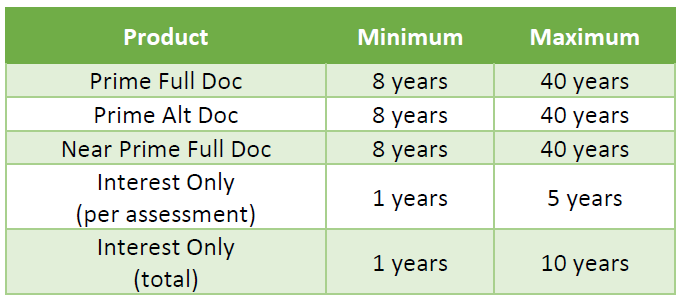

1. Introduction of 40 Year Loan Terms – Prime, Near Prime & Alt Doc Loans*

We have increased our loan terms across our Essential Options product suite out to 40 years. The longer loan term assists your customers to borrow more money.

2. Directors Salaries – Salaried Self Employed – Available on Prime Full Doc up to 80% LVR

This policy enhancement is designed for business owners that are well established, and have been paying themselves a consistent and regular wage for a minimum period of 6 months, and where no further business income is required to demonstrate servicing capacity.

One of the following items are simply required to support using the salary :

- Minimum of the latest 2 computer generated payslips with YTD evidencing a minimum of 6 months’ salary receipt. This may be complimented with a historic payslip with YTD confirming at least 6 months earnings.

- Bank statements showing regular and consistent income being deposited.

AND

- Written verification from the clients Accountant, in a format they are comfortable providing (letter or e-mail). However, this is subject to the minimum information requirements which are detailed below:

- If in letter format, must appear on accountant business letterhead.

- If in e-mail format, to be relied upon, must be from a professional business e-mail address with a registered business domain. A generic domain will generally be unacceptable.

- Key content to be covered:

- Full name and position of person providing the accountant verification

- Customers full name and legal/financial association with entity(s)

- Confirmation the accountant/tax agent for the above-named applicant/s and trading business and has acted for them in this capacity for at least twelve (12) months

- Confirmation that Entity(s) have been operating profitably over the previous years and able to continue to pay the salary as evidenced

- Establish that the business has been operating in its current structure for a minimum of 2 years

3. Introduction of Common Debt Reducer. Available on all products except for any loans subject to Lenders Mortgage Insurance

Under the Essential Options product, Resi can consider an apportionment of the debt servicing if certain circumstances are met (this would also extend to apportionment of any rental income generated also).

1. Non-applicant signs Resi Short Consent Form (not for credit checks, but allows for the storage of their personal information).

2. Satisfactory evidence of joint loan conduct for the previous 6 months (this may be evidenced by CCR data or loan statements).

3. Evidence of the non-applicant’s contributions towards the common debt, this may be by way of:

- A statutory declaration from the non-applicant confirming:

a. Full name of non-applicant

b. Address of the jointly owned property

c. Percentage ownership

d. Current & Future loan contribution dollar amount and percentage of overall payment

e. A template for the Statutory Declaration will be made available in the document library

OR

- 6 months of bank statements clearly demonstrating the non-applicant’s personal contribution towards the joint debt.

4. Acceptance of Non-Standard rental Income – Available on all Product types

Under the Essential Options Product range – Resi can now consider more non-standard rental income

Therse include:

- AirBnB

- Boarding Income

5. Continuing ATO Debt Payment Arrangements – Available on Near Prime Loans.

Resi can now consider ATO Debts to remain on their current arrangement under certain circumstances.

Resi can consider applications where payment arrangements are not being discharged and are to continue along with our proposed loan(s). This is not acceptable under our Prime range of loans and details of the full tax debt will need to be provided.

Requirements:

- Current amount of ATO debt is to be evidenced and the payment commitment is to be included in the servicing calculation.

- The proposed loan plus the ATO debt must not exceed the product loan amount and LVR parameters.

- Broker background notes must detail how this situation arose and what measures the borrower and/or their accountant has put in place to ensure that it does not re-occur.

6. Introduction of OSKO – Post settlement loan management improvements.

We are pleased to say that we have made improvements to our loan functionality for our customers. Redraws and Pay-Anyone transfers are now OKSO enabled, which means transfers are almost instantaneous if made to an OSKO participating institution/account.

Historically our payment transfers were subject to normal clearance times which could cause borrower frustration. We are confident that these changes will improve the post settlement customer experience.

OSKO functionality will be initially enabled for new borrowers and will be rolled out to the balance of the portfolio over the coming month.

Resi is making more changes to assist you and your clients with their lending requirements. Look out for our next announcement on the policy enhancements.