Following feedback from our broker network, RESI is announcing a stream of exciting product and policy enhancements, which will be introduced over the coming months in various stages. These changes will include:

- credit policy enhancements

- new products

- process and system improvements

Please review the content below in detail, as these changes will be introduced by June 1, 2023, to ensure we continue to offer solutions that best serve your customers and make it even faster for you to do business!

In essence, we are making it “simpler” for you and your customers to do business with us!

Today is the first launch of FOUR key updates you need to be aware of:

What’s changing?

Key Product and Policy Updates you need to know across the Essential Options product range:

1. 90% rental income allowance (10% shading)

Rental income shading has been reduced from 20% to 10%.

This applies across our entire Essentials product range, meaning for investment property scenarios we will be able to lend your clients more!

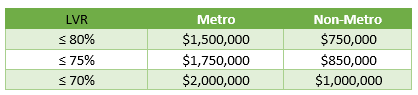

2. Prime Alt Doc Loan size / LVR matrix changes

You told us that our loan sizes needed to increase, especially in the capital cities. And we listened. As a result of this feedback, the loan size and LVR limits have been lifted for Prime Alt Doc, up to $2m (for Metro locations)*.

The new loan size limits in place:

3. Living expense requirements streamlined

Based on your feedback, we are introducing changes to streamline the Living Expense verification process. We’ll do this by reducing the instances where you need to provide us with Bank Statements.

Rather than bank statements being required on these products when the NSR falls below 1.25:1, we have introduced a simple annual surplus approach which reduces the instances where bank statements are required – to understand this update, contact your relevant BDM

4. Streamlining our processes to speed up turnaround times including modifications to ASIC searches, PAYG verifications and credit history explanations.

Click here to access the new serviceability calculator.

Other changes being introduced today, include:

- Aggregation limits are increasing.

- Removal of genuine savings requirements for loans above 90% LVR. More details will follow soon.

What’s next?

We’ve introduced these changes to provide more solutions to a broader range of your customers, with additional changes and announcements to come over the next few months.

We’re excited by the opportunities ahead for us.

Please send any enquiries about these announcements to your Resi BDM, Broker Support or your relevant YBR/VOW State Manager/BDM.

Disclaimer:

This information has been prepared by Resi Mortgage Corporation Pty Ltd, Australian Credit Licence 390669, Australian Company Number 092 564 415 (“Resi”). Information is correct as of 31 May 2023. It is intended for internal use only and is not to be distributed to anyone without the consent of Resi. Applications are subject to credit assessment and eligibility criteria. Terms, conditions, fees and charges apply.